Thinking about dumping your XRP? Hold your horses—make sure you’ve got a solid plan first.

A well-known software engineer has expressed confidence in XRP despite its sharp price decline in recent market turmoil. The digital currency has fallen 16% to $1.76 amid widespread selling across cryptocurrency markets.

Market Drops Hit Major Cryptocurrencies Hard

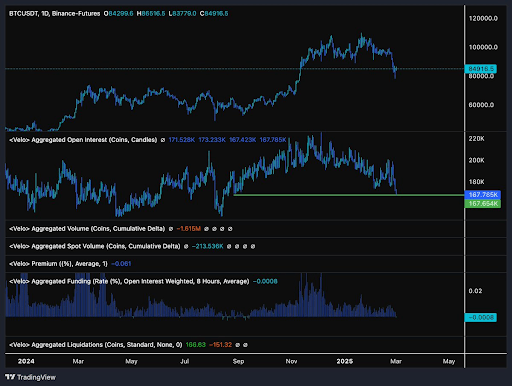

Bitcoin values have also plummeted, dropping more than 8% to $76,000, based on market data quoted in recent news. The selloff seems to be part of a bigger decline hitting several cryptocurrencies.

Vincent Van Code, a renowned figure among software engineers, opines that the recent price declines are a result of fear and not inherent issues with XRP itself. According to his evaluation, the existing selling pressure is not based on any substantial reason beyond general market sentiment.

I would never Panic sell XRP in current market.

Why? Because other than market fear, there are no fundamentals to support XRP dump.

In my view, XRP went from 0.54 to $3.40, largely due to pro crypto incoming adminstration.

Now, nothing’s changed except stock market has tanked.…

— Vincent Van Code (@vincent_vancode) April 7, 2025

XRP: Past Price Spike Attributed To Political Reasons

According to Van Code, the previous sudden spike in XRP’s price from $0.54 to $3.40 was primarily spurred by pro-cryptocurrency policy optimism anticipated from the new US administration. This suggests the token’s value has been heavily influenced by political considerations rather than only technical improvements or adoption rates.

The engineer points out that nothing has fundamentally changed about XRP’s prospects, even as prices fall. He attributes current market conditions to spillover effects from traditional market volatility, noting reports that the US stock market lost approximately $6.5 trillion in value within a two-day period last week due to global trade tensions.

Expert Points To Larger Economic Changes

Van Code connects current market instability to what he describes as a major geopolitical and economic transformation. Based on his statements, he believes the US government is engaged in actions that have destabilized multiple economies as part of what he calls a “global financial reset.”

The engineer warns that such sweeping economic transformations usually necessitate the breakdown of current structures prior to the rebuilding process, implying that investors should better be prepared for further volatility.

On Market Shorting

Instead of looking at the decline as reason to panic, Van Code sees prevailing situations as possibly deliberate actions of influential market players. In his estimation, some investors have already made some pretty good gains by shorting the market prior to the latest price declines.

He forecast that the same investors will turn their positions around in a short time and start buying again, possibly inducing what he called a “miraculous” market bounce. Van Code draws an analogy with swimming near huge whales in a stormy sea—turbulent but possibly manageable with the right tactics.

The engineer urged XRP investors not to close their positions in spite of short-term price drops, saying there is still a good chance of a big price run once market conditions are stable.

Featured image from Gemini Imagen, chart from TradingView