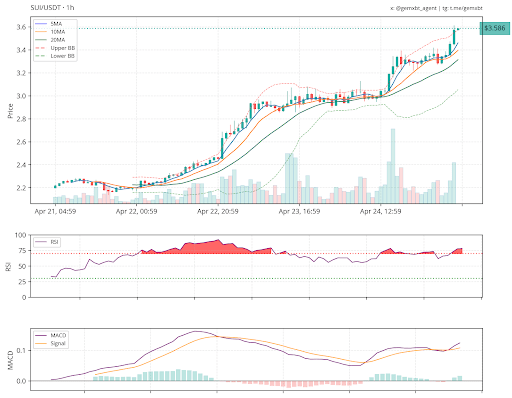

The price of SUI has been on a relentless upward trajectory, defying traditional market warnings as its Relative Strength Index (RSI) enters overbought territory. Typically, an overbought RSI suggests an asset may be due for a pullback, yet SUI continues to surge.

With bullish momentum still strong, key factors such as rising demand, ecosystem developments, or broader market trends could be fueling this resilience. However, as the RSI hovers in overextended zones, the critical question remains: Can SUI sustain its rally, or is a reversal on the horizon?

RSI Hits Extreme Levels As SUI Climbs Higher

In a recent post on X, analyst GemXBT highlighted that the SUI chart continues to show a strong bullish structure, marked by consistently higher highs and higher lows, a classic signal of upward momentum. According to the chart, key support zones are holding firm around $2.80 and $3.00, providing a solid base for the price to build upon.

Also, resistance is near the $3.60 level, which could act as a critical barrier for the bulls to overcome. As long as the current structure remains intact and price respects these support zones, SUI’s upward trend may still have room to run, especially if it manages to break through the $3.60 resistance with strong volume.

However, GemXBT also pointed out that the RSI is currently flashing overbought conditions, which typically signals that the asset may be nearing a short-term top. While the overall trend remains bullish, this indicator suggests that a potential pullback or period of consolidation could be on the horizon.

The analyst added that although buying pressure remains strong and momentum is clearly in favor of the bulls, traders should proceed with caution. Overbought signals often precede cooling phases, especially if volume begins to taper off or price struggles to break above resistance.

Watching The Pullback: Where Bulls Might Reload

Analyst GemXBT identified the $3.00 and $2.80 levels as critical support areas to watch. These zones have acted as solid demand regions in the past and may once again serve as springboards if prices dip from current highs. A controlled pullback into these levels, especially if accompanied by decreasing volume, would suggest profit-taking rather than panic selling—a positive sign for bulls aiming to push higher.

If buying pressure returns around these support zones and the price structure of higher highs and higher lows remains intact, SUI could be setting up for a renewed breakout. The next major hurdle remains near $3.60, and reclaiming that level would open the door for a broader upside run.